.png)

TradeWaltz:

• TradeWaltz, Inc., offers a cross-industry trade-information collaboration platform called TradeWaltzTM aimed at digitizing global trade.

• The company provides value-added trade data in commerce, logistics, and finance.

• The platform utilizes blockchain technology to increase the operational efficiency of the global trade industry through digitization.

• Future features include digitizing compliance checks, providing real-time credit ratings, and tracking shipments with IoT sensors.

Goals:

• Replace outdated cross-industry communications with digital solutions.

• Reduce time and hard costs of shipping transactions for clients across geographies.

• Reduce obstacles for small and medium-sized companies to enter the global trade market.

• Improve access to remote work and remote work technologies.

• Ensure the security of information and data for all stakeholders.

Approach:

1. Define the risks and costs of maintaining analog systems.

2. Form a consortium of Japanese trade partners for pilot projects.

3. Partnered with NTT Data to design TradeWaltz® platform using Hyperledger Fabric.

4. Roll out the solution to the initial users.

Results:

• Increased efficiency by 47% in actual usage

• Enabled remote work options

• Digitized 85% - 90% of standard trading documents

• Expanded consortium and user base across five economies of the Asian-Pacific region

Summary

Running a business on legacy technology and systems is easy—until it’s not. Sometimes, an industry doesn’t realize how far behind its technology is until a major disruption reveals the lag.

For the global shipping and trade industry, the COVID-19 Global Pandemic was this disruption. It revealed a profound technological lag in systems and processes.

Most of the industry still operated using analog systems, such as paper and PDF documentation. Stakeholders such as banks, insurance companies, government entities, and importers and exporters struggled to communicate efficiently, even under normal circumstances.

Analog systems may have been slow, but they did work. At least they did as long as there were employees to handle documentation. But, when COVID-19 struck, restrictions meant that employees couldn’t show up in person.

The paper- and PDF-based industry couldn't offer remote work, so entire global shipping markets came to a screeching halt.

Fortunately, someone was already looking at ways to streamline global trade. In 2017, a cross-industry consortium was launched. In 2020, TradeWaltz Inc. was founded with the vision of creating a digital future of global trade.

The premise was simple: Digitize documentation and processes through user-friendly interfaces that leverage the platforms companies already use.

Full digitization would allow easier communication between all parties. And it would streamline processes to save time and money.

But TradeWaltz knew that stakeholders would have questions and concerns about security. Global trade involves massive amounts of data. Regulatory compliance is also a factor with finance, insurance, and government entities in the mix.

How could a new digital platform ensure that all entities involved could preserve data integrity and security?

Defining the Risks and Costs of Maintaining Analog Systems

For many years, global trade lagged behind other industries in its technological innovation. Even in the post-pandemic era, much of the industry, particularly sea and air freight, still relies on analog communication methods. In Japan, a single transaction can take 72 hours; procedures may take 235 hours in Asia or even up to 400 hours in Africa.

Compare these times to just a few hours in much of Europe. It’s easy to see how markets can quickly fall behind their global competitors.

The cost of such transactions is equally significant. Each transaction costs an average of $350 US in Japan. Globally, these analog transactions can add up to $55 billion US per year.

Paper-based transactions and procedures also create a significant entry barrier for small to medium-sized businesses worldwide.

There is a high cost just to employ the large staff needed to perform these analog transactions. And then companies need warehouse space for storing paper documents. These increase entry costs into the marketplace, which makes financing tough to secure for these businesses.

Finally, as the workplace changes and more employees ask for remote working arrangements, filling positions requiring in-person employees to perform analog procedures is increasingly difficult.

Digital systems may help companies attract employees and meet the challenges of a global talent shortage. Reducing in-person workers can also help organizations reduce CO2 emissions and meet potential climate regulations.

Forming Consortium of Japanese Trade Partners for Pilot Projects

In 2016, NTT Data, a Japan-based member of Hyperledger Foundation, set out to expand into the trade industry. Previously, NTT Data provided blockchain security to the financial services industry. Now the organization saw similar challenges between financial services and trade.

“Financial services and global trade have similar situations,” says Satoru Someya, Managing Director, COO, CMO, and Head of Global & Alliances Business Department. “They both have so many stakeholders, so many transactions, so many unknown parties. They thought, ‘Could we use blockchain for global trade?’”

NTT Data approached Tokio Marine & Nichido Fire Insurance Company with a pilot project. It would create digitized insurance documents for trade.

After identifying several more projects for digitization, NTT Data gathered several banks, insurance companies, cargo owners, and trade logistics companies and carriers and created a 13-company trade consortium.

From 2017 to 2019, the trade consortium, which expanded to 18 member companies, identified cross-industry business issues. And it researched potential AI solutions, applications, and relevant legal and compliance issues. The first TradeWaltz test project launched in 2017 with The Networked Trade Platform (NTP) Singapore. Two more proof-of-concept projects rolled out in 2018 in Japan and Thailand.

Encouraged by these early successes, seven companies from the consortium invested in the company and officially launched TradeWaltz, Inc. in 2020, which was just in time for a global pandemic.

“We saw that the economy and technology were changing before COVID-19,” says Someya. By the time the pandemic arrived, everything was in place for TradeWaltz to provide digitized trade documents for companies who needed to allow remote work.

“Timing is everything. [When COVID-19 struck] TradeWaltz was ready to launch.

—Satoru Someya, Managing Director, COO, CMO

Partnering with NTT Data to Design TradeWaltz Platform Using Hyperledger Fabric

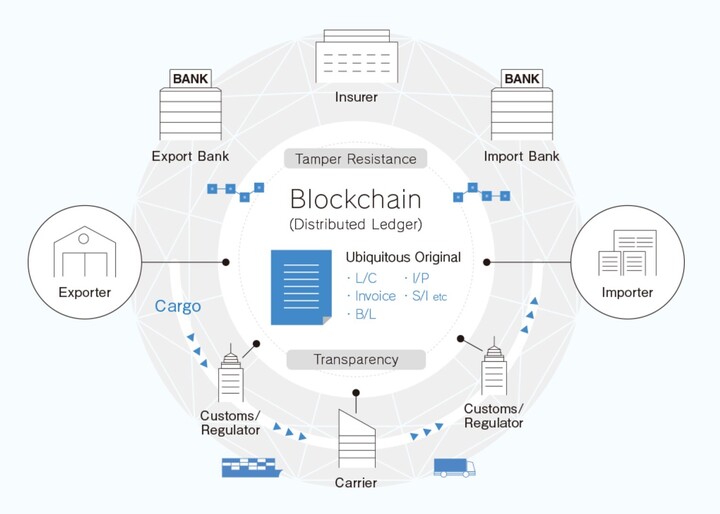

Based on its test cases, TradeWaltz created a cross-industry, all-in-one platform for the global trade market. The platform has three layers: a user interface, the application layer, and the blockchain layer. The blockchain layer uses Hyperledger Fabric.

TradeWaltz ensures data integrity at both the blockchain layer and the application layer. As the company expands nodes into more locations, multiple geographies will manage data to help ensure authenticity.

“Compared to B2C transactions, B2B transactions typically handle larger amounts of money and carry more risk of data falsification, especially across national borders,” says Someya. “We needed technology to guarantee data security for multiple nodes across borders with distributed ledgers.”

But companies that use the TradeWaltz platform don’t need to worry about a cumbersome, difficult-to-manage system.

“Our strategy was to connect the new system to existing hubs, such as SAP or Salesforce,” says Someya. The user interface makes sharing information simple, and the protection of blockchain on the backend protects all stakeholder data. “With one button, all parties can share information and data without risk,” says Someya. Users can still use their legacy systems and rely on the TradeWaltz API to share information securely with other players.

At the blockchain level, carefully selecting recorded information reduces recording volume and improves recording speed. It also enhances data governance by preventing data leaks across geographies. TradeWaltz envisions having nodes distributed to multiple countries, increasing reliability and enhancing data authenticity.

Rolling Out the Solution to Initial Consortium

The TradeWaltz platform design creates a trade ecosystem that allows players across the industry to easily exchange information through standard documents in digital form—without risking security breaches or exposure of other data.

Users across import/export, manufacturers, finance, insurance, logistics and carriers can all use TradeWaltz to quickly generate documents and instantly send them to relevant parties.

When documents are digital, there’s little to no lag time in communication. And employees can process information from anywhere, allowing remote work for a wide range of people.

Supported documents include permits, certificates of origin, insurance policies, invoices, shipping instructions, and more. Someya estimates that TradeWaltz has digitized 85% - 90% of standard document types for the current markets.

Since its initial rollout in 2017, the TradeWaltz platform has produced staggering improvements in efficiency in its pilot projects.

“The data show that cross-industry communication of users has become 47% more efficient in production use,” says Someya. Across the pilot projects in 2017 and 2018, the use of the TradeWaltz platform resulted in efficiency improvements between 44% and 60%.

“The data show that cross-industry communication of users has become 47% more efficient in production use.”

—Satoru Someya, Managing Director, COO, CMO

After initial projects in Singapore, Japan, and Thailand, NTT Data rolled out the TradeWaltz pilot platform to 24 companies in Thailand in 2019.

TradeWaltz continues to grow its trade consortium and user base. Currently, there are 200 companies in the Trade Consortium, of which TradeWaltz serves as the secretariat, and 30 user companies across five Asia-Pacific economies (Japan, Singapore, Thailand, New Zealand, and Australia) and 60 user companies in Japan. TradeWaltz also works with various government agencies.

What’s Next/Future Steps

TradeWaltz estimates that the total market for digitized data services in global trade could be as high as $825 billion US. The company aims to expand its consortium and user base across geographies to achieve a vision of digitizing global trade.

Once all the standard documents are digitized and supported on the platform, TradeWaltz will continue improving the platform’s value through additional services.

These include adding a digitized compliance check for hazardous and regulated materials and generating real-time credit ratings based on transaction data.

TradeWaltz also plans to roll out an IoT tracking feature to allow users to automatically track the fulfillment of contracts. The company has successfully completed a pilot project to attach IoT sensors to cargo to gain real-time tracking information.

In 2021, TradeWaltz Inc. became the first company in the world to successfully demonstrate that bill of lading information can be transferred from its Hyperledger Fabric network to another company's Ethereum-based financial blockchain. This was made possible through the use of a technology called atomic swap and settled in USDC stable coins.

The TradeWaltz mission is to “create the future of trade.” Someya says that the company’s goal is to completely digitize trade processes and create a data-driven industry model that supports global trade through value-added services that use accumulated data.

“We envision a future where trade procedures can be automated, for example, by combining contract information, logistics information, and payment functions with smart contracts on Hyperledger Fabric,” he says.

Someya also sees the digitization of trade as a way to reduce barriers to entry for small- to medium-sized businesses.

“There are hurdles to get into global trade for smaller businesses,” he says, pointing to the high cost of office space, human resources, and warehousing. By streamlining much of trade through digital processes and documents, TradeWaltz reduces these costs and helps SMBs enter the market faster.

Someya envisions continuing a long and prosperous relationship with the Hyperledger community and contributing to the open source codebase. “In Japan, there is a term called “On-okuri,’” he says. “It is a concept that when you receive a favor from someone, you send that favor to the next generation.”

“In Japan, there is a term called ‘On-okuri.’ It is a concept that when you receive a favor from someone, you send that favor to the next generation.”

—Satoru Someya, Managing Director, COO, CMO

For the next generation, that favor may return in the form of resilient supply chains and a more robust trade ecosystem. In the TradeWaltz vision of the future of trade, disruption will be a bygone memory of the analog era.

About NTT Data

NTT DATA - a part of NTT Group - is a trusted global innovator of IT and business services headquartered in Tokyo. The company helps clients transform through consulting, industry solutions, business process services, IT modernization and managed services. NTT DATA enables clients, as well as society, to move confidently into the digital future. The company is committed to our clients' long-term success and combines global reach with local client attention to serve them in over 50 countries. For more information, visit nttdata.com/global/en

About TradeWaltz

TradeWaltz, Inc. is an industry-government-academia All Japan trade DX startup jointly owned and operated by sixteen large companies, including NTT DATA and Toyota Tsusho Corporation. The company offers TradeWaltz®, a cross-industry trade-information collaboration platform that utilizes NTT DATA’s patented blockchain technology to increase the operational efficiency of trade practitioners by over 47%, enable remote work, and promote business visualization. To learn more, visit tradewaltz.com/en.

About Hyperledger Foundation

Hyperledger Foundation was founded in 2015 to bring transparency and efficiency to the enterprise market by fostering a thriving ecosystem around open source blockchain software technologies. As a project of the Linux Foundation, Hyperledger Foundation coordinates a community of member and non-member organizations, individual contributors and software developers building enterprise-grade platforms, libraries, tools and solutions for multi-party systems using blockchain, distributed ledger, and related technologies. Organizations join Hyperledger Foundation to demonstrate technical leadership, collaborate and network with others, and raise awareness around their efforts in the enterprise blockchain community. Members include industry-leading organizations in finance, banking, healthcare, supply chains, manufacturing, technology and beyond. All Hyperledger code is built publicly and available under the Apache license. To learn more, visit hyperledger.org

Copyright © 2022 The Linux Foundation ® . All rights reserved. Hyperledger is a trademark of The Linux Foundation. See Privacy Policy and Terms of Use.